The Role of Ontology Management in Financial Governance

Learn how ontology management simplifies compliance, boosts data accuracy, and enhances decision-making in financial services governance

Over the past year, banks globally faced more than $3.6 billion in penalties, with transaction monitoring failures making up the overwhelming majority. Behind these staggering numbers lies a painful truth: most banks are still relying on fragmented systems, inconsistent definitions, and manual processes to manage the lifeblood of their operations. At its core, the issue isn’t just about technology. It’s about trust. Banks need to be able to trust their data at every stage, from its very first point of capture to the reports sent to regulators and stakeholders. Without that trust, every decision carries risk.

It All Starts at the Source

What if your customer data collected across multiple channels were usable from the very beginning?

Customer details like names and addresses are instantly cleaned up and standardized. Any duplicate records are merged, so banks get one clear view of each customer. Compliance checks for politically exposed persons (PEPs) or sanctioned individuals happen automatically, reducing the risk of errors before data flows downstream.

With a solid data foundation, everything improves. Reliable data drives reporting, governance, and AI systems. Teams stop wasting time on reconciliation and start focusing on innovation. Most importantly, regulators gain confidence in the institution’s ability to deliver accurate, auditable reports. But even perfect data quality isn’t enough. Banks also need a shared language to connect every team, every system, and every decision.

Bridging the Gap with Ontology Management

Across departments, banks often speak in different dialects of data. What risk management calls a “loan” may differ from how finance defines it. These mismatches lead to confusion, reporting delays, and regulatory missteps.

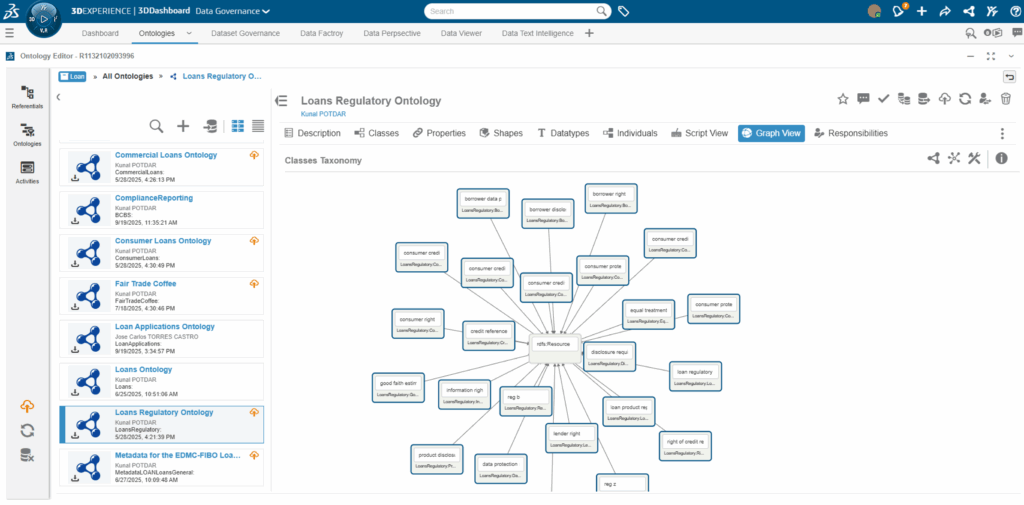

The solution starts with ontology management. By defining a unified set of business semantics, banks establish a shared language that connects compliance, risk, finance, and IT teams to lay the foundation for stronger governance.

On top of this, data modeling brings structure and traceability. Logical and physical data models ensure every data element aligns with key regulations such as BCBS 239, GDPR, and MiFID II. These models link high-level business terms directly to the systems and reports regulators depend on, providing full transparency and accountability.

All of this must happen in a collaborative environment where updates are versioned, tracked, and auditable. Metadata stewardship ensures ownership, while clear lineage shows exactly how data flows across the bank.

When ontology management and data modeling work together, banks move from fragmented governance to a single, connected framework. The result: faster compliance reporting, stronger regulatory alignment, and a trusted data foundation ready for analytics and AI innovation.

Ontology Management brings a single, connected framework for an efficient data governance

A Unified Approach to Data Quality and Governance

At the 8th Annual Data Governance & Compliance conference for Financial Institutions in Frankfurt, conversations revealed the human toll of fragmented governance. Data officers spoke of sleepless nights before audits. Governance teams shared frustrations over duplicate records and conflicting reports. Risk managers described the difficulty of explaining to regulators why their numbers didn’t match. Most vendors address only part of the problem. Some focus on cleansing data, while others focus on governance frameworks. But solving today’s challenges requires both.

They need a holistic approach that connects trusted data quality and a robust, ontology-driven governance, into a single, seamless strategy. In another word, an end-to-end approach is needed to support bank being compliant, resilient and innovative.

This is where TOLERANT Software and Dassault Systèmes come together.

- TOLERANT Software ensures that data is clean, standardized, and trustworthy at its source, removing duplicates, merging records, and streamlining compliance checks.

- Dassault Systèmes helps banks build a unified governance framework through ontology management and data modeling, transforming complex processes into a seamless, auditable system that drives faster reporting and stronger regulatory confidence

Click to discover more about how TOLERANT Software supports banks in the areas of data protection regulations and compliance guidelines.

Your Next Step: See It in Action

If you joined us in Frankfurt, now is the time to turn insights into action. We invite you to book a personalized demo where you can see how TOLERANT and Dassault’s combined solution works in real-world scenarios. In just 30 minutes, you’ll witness how clean, trusted data seamlessly integrates with a governance framework designed to handle the complexities of modern banking.

Connect today!

Taherah KUHL

Vice President Business Services Industry, Dassault Systèmes