Things to know about SEPA

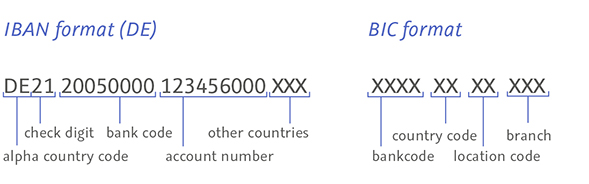

The SEPA advertising film of the Federal Ministry of Finance is as beautiful as what it promises: a bright, shiny world with simple, inexpensive payment transactions, clear relationships and plenty of relaxed Europeans. In Germany, for example, it is enough to write the bank code and account number one after the other, preceded by the national abbreviation “DE” plus a two-digit check digit, which the account-holding bank informs you of – and there you have the new International Bank Account Number, or IBAN for short. This allows cashless payments and withdrawals in 34 countries between North Cape and San Marino. So much for the colourful cartoon version. Unfortunately, it does not quite match the real situation.

As is often the case when European compromises have to be made, one thing in particular thrives – the exception. And this biotope is not only densely populated, but also in constant flux. Instead of a binding rule for the creation of IBANs, there are currently 57 in Germany, which are updated, i.e. changed, on a quarterly basis. This can be read in the quarterly publications of the Deutsche Bundesbank; the current rules for creating account numbers (about 130), as well as the respectively valid bank sort codes, currently about 4,000, appear there at the same time. In the next quarter, new standards will most likely apply. And unfortunately, all these factors are relevant for the creation of a valid IBAN.

Non-private bank customers, i.e. mainly companies of all kinds, have a final deadline in Germany until the first of August this year to change over their payment transactions.

The next best internet offer for IBAN conversion may be thoroughly misleading. Many conversion tools ignore the complicated rules, produce invalid IBANs and cause a lot of trouble for unsuspecting users. Anyone who has ever searched for a misdirected foreign transfer knows the problem.

The TOLERANT Bank software helps with the changeover to SEPA with the utmost reliability: it automatically checks German account numbers and bank sort codes. It creates new IBANs and validates existing ones by determining the underlying account number and sort code. Conversely, the programme makes it possible to read the account and bank data of a foreign partner from their IBAN. German banks can be searched for by name and location. The BIC, an international bank code that is expected to be required in international payment transactions until February 2016, is also checked.

Shutterstock

Shutterstock